Tabby raises $23m in largest ‘Series A’ funding round in the Middle East

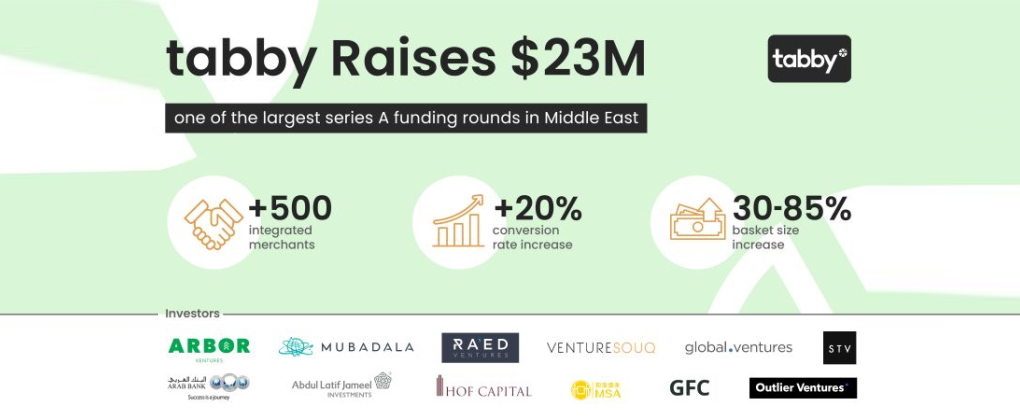

Tabby, the Fintech platform and buy now pay later (BNPL) provider, announced raising $23 million in the largest ‘Series A’ funding round in the Middle East. Arbor Ventures and Mubadala Capital led the funding round with participation from STV, Raed Ventures, Global Founders Capital, JIMCO, Global Ventures, Venture Souq, Outliers VC, MSA Capital, HOF, and Arab Bank.

Tabby was founded in 2019 by Hosam Arab in the United Arab Emirates. It offers a “buy now, pay later” solution to their consumers by allowing them to buy their products from Tabby partners and choose either pay later or pay via installment in four equal monthly installments at zero cost.

“The shift to online retail has never been more evident, and with it, consumers are becoming ever more demanding as they actively seek convenience and reliability in their shopping experience. And this includes how they pay for their purchases. We’re very proud of the value we’ve been able to bring our retail partners by providing their customers with an exceptionally convenient and flexible way to pay.” Hosam Arab, co-Founder, and CEO of tabby.

Today, Tabby offers its services in the United Arab Emirates and Saudi Arabia with more than 500 merchants, including leading global brands like IKEA, Toys R Us, Ace Hardware, and others. The company plans to benefit from the funding in expanding it's business and capabilities, and offering more benefits to retailers and customers at the same time.

“We are very excited to have backed tabby, the leader in Buy Now Pay Later in MENA which is at a tipping point in digital payments. tabby’s network is expanding rapidly, and the company continues to innovate to offer the best in market solutions for merchants and new frictionless payments for consumers.” Melissa Guzy, Managing Partner at Arbor Ventures.

EgyptInnovate site is not responsible for the content of the comments